Soil Association Certification’s Organic Market Report 2022 reveals the UK organic market is now worth a record £3.05 billion after a 5.2% growth in sales in 2021, with shoppers spending almost £60 million on organic products every week. However, figures released by FiBL this week shows that the European market, as a whole, is growing even faster and reached a record high in 2020. It increased by 15% and reached €52.0 billion, the highest growth rate in the past decade. The organic farmed area continued to grow, too, increasing by 5.3% in the European Union, as compared to the UK which increased by just 0.8% in the same period (Defra statistics).

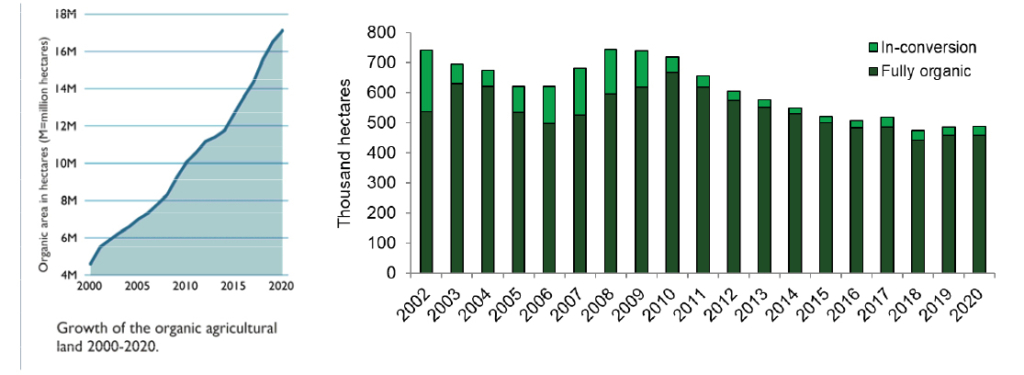

In 2020, 17.1 million hectares of farmland in Europe were organic (European Union: 14.9 million hectares). With almost 2.5 million hectares, France became the new number one country in terms of farmland under organic management, followed by Spain (2.4 million hectares), Italy (2.1 million hectares) and Germany (1.7 million hectares). The UK has 489,000 hectares of organic land. France reported 307,000 hectares more than in 2019, Italy had over 102,000 hectares more, and Germany had over 88,000 hectares more.

In 2020, organic farmland in Europe constituted 3.4% of the total agricultural land and 9.2% in the European Union. In Europe (and globally), Liechtenstein had the highest organic share of all farmland (41.6%), followed by Austria, the country in the European Union with the highest organic share (26.5%). In the UK 2.8% of the total farmed area is organic. Fifteen European countries reported that at least 10% of their farmland is organic.

There were almost 420,000 organic producers in Europe and almost 350,000 in the European Union. Italy had the largest number (71,590). In 2020, there were 3,581 producers registered with the organic certification bodies in the United Kingdom.

There were 84,799 processors in Europe and over 78,000 in the European Union. Over 6,800 importers were counted in Europe and almost 5,800 in the European Union. The country with the largest number of processors was Italy (nearly 23,000), while Germany had the most importers (more than 1,900). The UK had 2,566 processors and 216 importers of organic food in 2020.

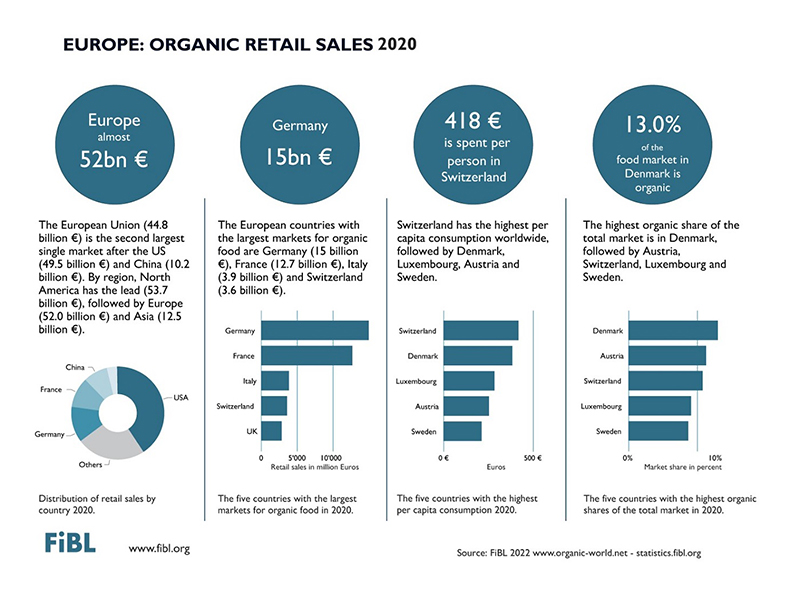

Retail sales in Europe were valued at €52.0 billion (€44.8 billion in the European Union). The largest market was Germany (€ 14.99 billion). The European Union represents the second largest single market for organic products globally after the United States (€49.5 billion).

The European market reached a record growth rate of 14.9%, the highest in the last decade. Among the key markets, the highest growth was observed in Germany (22.3%). In 2020, the organic markets in many countries exhibited double-digit growth due to the pandemic as people stayed home and began to cook more often. Health, environment and climate change have become important issues. If this trend continues, production and processing have to keep pace. The Farm to Fork strategy of the European Union can support this development with respective measures.

In Europe, consumers spent €63.3 on organic food per person annually (European Union: €101.8). Per capita, consumer spending on organic food has doubled in the last decade. In 2020, Swiss and Danish consumers spent the most on organic food (€418 and €384 per capita, respectively). UK consumers spent only €44.8 (£37.60) per person on organic food in 2020.

Globally, European countries account for the highest shares of organic food sales as a percentage of their respective food markets. Denmark has the highest organic food sales share worldwide, with 13.0% in 2020, followed by Austria with a share of 11.3% and Switzerland with 10.3%.

The UK organic market has enjoyed ten years of positive growth despite the pandemic and the on-going challenges thrown up by Brexit. The report shows strong performance across all food and drink sectors including supermarkets (+2.4%), independent retailers (+9%), food service (+3.3%), and with particularly strong performance for online and box schemes which together delivered growth of 13% worth £558m.

Online purchases have continued to show phenomenal growth which, including box schemes, have seen total sales growth of 13%. This is on top of the exceptional performance the sector saw in 2020 (36.2%) showing a massive 54% increase since 2019 when sales were at £362.9m. Customers who bought organic online and used box schemes following the pandemic have continued with their new shopping habits. Online has enabled retailers to offer a wider range and choice of products which is attributed with attracting more customers to organic and its strong growth. Amazon is now the largest online retailer of organic in the UK with over 8,5000 Soil Association Certification products.

After a huge increase in 2020, sales of organic in supermarkets in 2021 levelled but still grew by 2.4%. So organic food and drink sales in in the supermarkets including home delivery was worth £1.97 billion. Waitrose & Partners, Sainsbury’s and Tesco still dominate multiple retailer sales of organic, with a 65% share of the market.

In the supermarkets the top four organic categories contribute three quarters (74%) of sales and are growing ahead of their non-organic equivalents. These are dairy (with almost £500m sales up 0.7% on 2020), produce (£438m up 1.8%), ambient grocery (£315m down 6.2%), and meat, fish and poultry (£202m up 5.5%). Organic has been given more focus across supermarkets with Sainsbury,s,

Ocado, Tesco, Waitrose & Partners and Marks & Spencer getting behind Organic September in 2021 boosting organic sales in that month by 1.3% versus 2020. They also gave greater prominence and marketing support to organic categories and products across stores and online across the year.

It has been another mixed year for independent retailers selling organic, but the sector has come back into growth as more stores have been able to open. Some city centre retailers have been negatively affected by more people working from home, but many local stores have benefited from this change. Overall, the sector has seen an increase in sales of 9% in 2021.

The challenge for UK farmers and supply chains now is to step up to meet the demand presented by the strong growth in the organic market. Land in conversion is not increasing sufficiently fast enough (12% in 2020) and there is a need to develop robust UK supply chains. At present more ingredients and products are being imported to support increased demand which is not what anyone wants. There needs to be robust supply chains – and the research shows consumers want to buy British.

OF&G (Organic Farmers & Growers) CEO and ORC Trustee Roger Kerr welcomed the positive data highlighted in the report and said:

“Sustained market growth of 5.2% must now be replicated with equivalent increases in land conversion to capitalise on the opportunity before us.

“With sales hitting £3 billion for the first time, consumer appetite for organic produce is strong. However, while organic land conversion rates remain relatively static there is an increased risk of reliance on imports. Working collaboratively with the English Organic Forum, we’re seeking to drive proactive policy action to secure unequivocal government support for organic.

“In terms of influencing consumer attitudes and behaviours, closing the ‘say-do gap’ is key. This can only be achieved through consistent messaging that repeatedly promotes the multiple benefits of organic and ingrains those positive purchasing choices so there is no going back.”