Soil Association Certification’s Organic Market Report 2023 reveals:

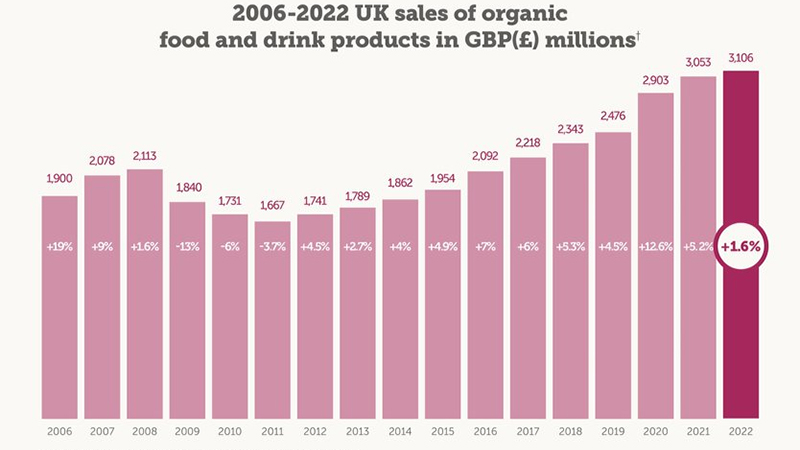

The UK’s organic market is now worth a record £3.1 billion driven by 1.6% growth in sales in 2022, with shoppers spending almost £8.5 million on organic products every day in the UK.

The organic market has enjoyed its 11th year of positive growth despite the cost of living crisis, record inflation, heightened levels of uncertainty arising from the Russian invasion of Ukraine together with its impact on world food markets and energy prices, and the on-going challenges thrown up by Brexit.

Soil Association Certification Commercial Director Alex Cullen said: “With sales exceeding £3.1 billion we have seen a transformation in the organic food and drink market since the pandemic with a phenomenal 25.4% growth in just three years. Despite the economic turmoil and significant challenges everyone faced

in 2022 the organic market delivered a strong and resilient performance growing a respectable 1.6%.

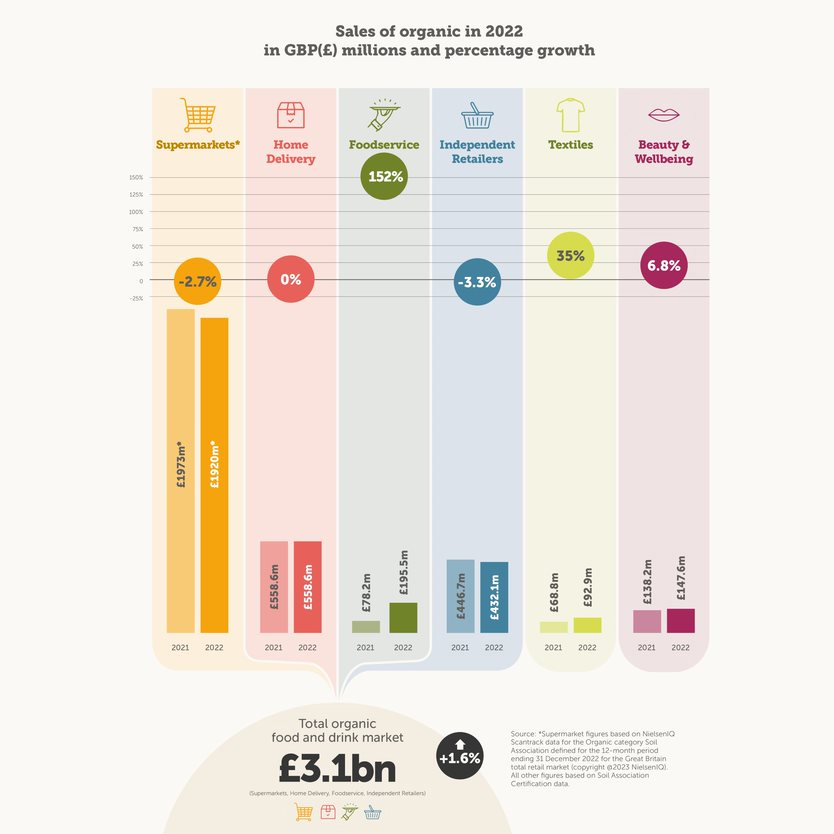

“In these challenging conditions organic foodservice delivered a stellar performance growing 152% and helping to drive this uplift while organic food and drink sales in supermarkets, independent retailers and home delivery had mixed fortunes with shoppers forced to make hard decisions on their weekly shop as they faced the cost of living crisis.

“Today eight out of ten supermarket shoppers buy organic and many are cutting their spend or switching to conventional products because of price pressures. But crises don’t last forever. Inflation will come down and shopper confidence will return. In organic there is an amazing momentum building with the potential for strong future growth captalising on the high levels of consumer trust and confidence it holds by meeting their needs for sustainable and healthy food. The more economies of scale we can build across the organic sector the more we can bring down prices and make high quality, healthy organic food accessible for all.”

In a year where the discounters won market share as consumers increasingly looked for value as the cost of living crisis took hold, 2022 saw consumers looking hard at their shopping bills and making tough choices. Organic sales in supermarkets fell 2.7% with share of category dropping from 1.8% to 1.7% – but the market remains sizeable – worth £1.92 billion.

In the final four weeks of the year organic sales in the supermarkets rallied and returned to growth of 0.5% – although lagging behind non-organic. This follows eight years in which organic food and drink has grown faster than non-organic and over the long term, the organic sector’s positive potential in

supermarkets is clear and reflected in the compound annual growth rate (CAGR) for organic at 5.39%, compared to 1.83% for non-organic.

Despite facing multiple pressures and another challenging year foodservice saw organic sales grew by an incredible 152% as sales leaped to £195.5m (from £78.2m in 2021) largely driven by sales of organic hot drinks and milk in a number of leading café chains – highlighting the public’s appetite for quality

sustainable ingredients. But, the cost of living crisis has continued to impact the number of people eating

out, while wage pressure (and Brexit) made it hard for operators to attract and retain staff. Nevertheless, the hospitality sector has shown great resilience and willingness to embrace consumer trends pointing to future growth.

In home delivery, despite a mixed performance across companies, sales were flat at £558.6m following phenomenal growth during lockdown where sales grew from pre-pandemic levels of £362.9m. There were winners and losers as consumers spent less time at home and faced inflationary pressures but this in

turn has driven innovation, new technology solutions and broader organic product ranges.

Independent retailers faced a challenging year with sales dropping 3.3% to £432.1m following a buoyant period during the pandemic when some retailers were classed as ‘essential businesses’. Over the last year they faced the challenge of trying to retain these new customers but also saw shoppers spend less and shop less often. Over 60% of retailers saw inflation as the number one challenge but two thirds believe that sales will increase in 2023.

All UK farmers faced huge challenges in 2022 and organic farmers were not immune from those pressures. Inflation and supply chain disruption meant the cost of doing business for farmers rose as heating bills and feed costs rocketed. As the focus switched to value at supermarket checkouts, the price

farmers received for their products was under intense pressure. This inevitably impacted on organic farmers as people increasingly sought cheaper products. But, there was some relief for organic farmers as they weren’t impacted by escalating fertiliser prices sparked by the war in Ukraine. This also presents an opportunity for the organic farming movement to grow as conventional farmers look for cut costs.

The data for 2022 has not yet been released, but it was encouraging to see the amount of organically farmed land rise by 3.6 per cent to 507 thousand hectares in 2021. This includes a big jump in the land going through conversion to organic, which was up 34 per cent.

Soil Association Organic Farming Advisor Adrian Steele, who runs a mixed organic farm with cattle and both arable and horticultural crops in Worcestershire, said: “Now more than ever there is a more important role for nature-friendly farming like organic and governments around the world are

recognising that. For too long our broken food chain has prioritised industrially produced, cheap food – and this does put organic at a disadvantage during times of hardship for shoppers. But demand for fairer supply chains is rising alongside the need to deliver resilience for UK food production in the face of

the escalating climate and nature crises.

“Both the EU and Scottish governments have pledged to grow organic land significantly by the end of the decade, and although Westminster is dragging its heels on a similar policy they are backing organic through the doubling of support payment rates last year. The new Environmental Land Management

Scheme also incentivises many organic farming practices like eliminating insecticides and using legumes for soil fertility instead of chemicals.”

This year’s Organic Market Report includes a new Sustainability Report which highlights how fixing our broken food system demands a holistic approach from the roots up. The free mini-report features valuable contributions from leading global charities and NGOs the Soil Association works with WWF, Fairtrade Foundation and the Forest Stewardship Council, who are working right at the heart of the sustainability space, and who share the same holistic view of how we should be caring for our land and changing food and farming systems, regarding tackling climate change through the choices we make at the checkout.

As sustainable choices become more important to consumers and retailers, together with government’s legally binding commitments on the environment, it is vital that we have greater clarity and consistency in decision making. And organic with its established standards has the potential to provide this clarity

and proven credentials in delivering these healthy and sustainable choices. This emphasises that organic is a key solution as governments around the world are looking for the best quality solutions for the environmental, nature and health crises. As the Treasury looks for efficient investments to deliver on

the government’s net zero and nature commitments organic offers an established choice which addresses many of the key priorities backed up by evidence and verifiable standards. And as retailers and businesses shape up their sustainability profiles and commitments including their own Scope 3 emissions targets it is vital that supply chains are as sustainable as possible. Wise investment by business and Governments are essential to help consumers make the right choices at the checkout and to prioritise messages which make it clear how they can help to tackle climate change.

Alex said: “The Soil Association works closely with leading NGOS to advocate for a better food and farming system to tackle the environment, nature and health crisis. This year we have worked with WWF, the Fairtrade Foundation and FSC to produce a new Sustainability Report providing their visions on how

we tackle the climate crisis and how the choices we make at the checkout can make a difference.

“Organic is a good choice for governments, business and individuals because it is a ready-made solution for the climate crisis. Increasingly people are recognising the crucial role that organic farming can play in restoring nature, replenishing soils and providing clean air and water as well as nourishing

food.”

The Organic Market Report 2023 is published with the support of Triodos Bank UK and Natural & Organic Products Europe (NOPEX).